501(C)(3) Filings

Understanding the Role of 501(c)(3) Not-For-Profit Organizations

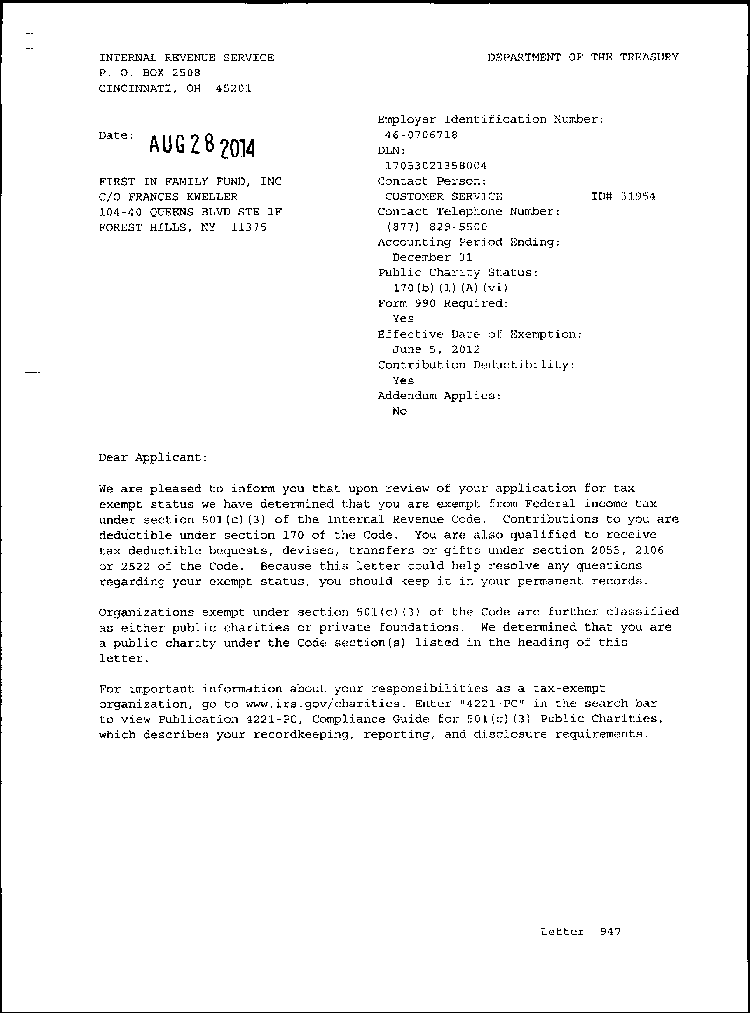

The First in Family Fund, Inc. is a registered not-for-profit organization with the State of New York in Queens, New York City (registration number 44-12-75). We hold a 501(c)(3) designation recognized by the IRS.

First in Family Fund Donations

Generous donations from corporate and private sponsors enable the First in Family Fund to provide free or low-cost premium tutoring and mentoring services to college-bound students from immigrant communities. Recipients of First in Family Fund scholarships receive training at Kweller Prep, a leading college preparatory program in NYC.

Kweller Prep’s network of tutors hail from leading educational institutions and have demonstrated excellence in both successful testing and academia. Scholarship recipients enjoy a multitude of Kweller Prep tutoring services, including:

- Entrance exam preparation

- Speech and debate team prep

- Computer science tutoring

- Support for the college essay process

- Mentoring through the college selection, qualification, and acceptance process

Emergency Relief Fund

All children in New York State have a right to K-12 public education, regardless of their or their parents’ immigration status. However, children of immigrants may face additional challenges when entering the U.S. public school system, including but not limited to learning a second language.

The First in Family Fund provides emergency academic support for children of immigrants in New York City. Our partnership with Kweller Prep allows us to provide these bright students with language, math, and other academic support programs to help them thrive at school.

Many students who receive support from the First in Family Fund and Kweller Prep during elementary or secondary school will go on to prepare for college as part of our tutoring and mentoring program. Kweller Prep’s welcoming environment also creates a safe space for students from immigrant communities to connect with other children of immigrants who are succeeding academically at all levels.

Your generous donations to the First in Family Fund’s emergency relief program will go toward providing rapid assistance to the children of immigrant families as they enter the New York City school system. It is with your help that these deserving students will receive the support they need to build a strong academic foundation and a love of learning.

About Your Donation

Donations to the First in Family Fund are tax-deductible. For more information, please see our “Giving to Education” resource, and speak to your tax preparer or accounting professional. They can provide additional information on how tax-deductible donations may influence your tax payments.

The cost to provide preparatory services, tutoring, and mentoring to one student can reach into the thousands. Your donations are vital in ensuring access to these programs for students who may not otherwise have the opportunity.

501(c)(3) Filing Help

Any parties interested in providing charitable services to New York City residents may benefit from pursuing their own 501(c)(3) designation. An organization’s services must meet and maintain compliance with several requirements as per the IRS. Many new organizations find it useful to engage a service that provides help filing a 501(c)(3) in New York. Steps to create a registered 501(c)(3) may include:

- Confirming and registering an available business name

- Obtaining a Federal Employer Identification Number (EIN)

- Developing a charter/articles of incorporation

- Establishing governing bylaws for board operation

- Creating a conflict-of-interest policy

- Registering with state agencies for sales tax exemption and fundraising

- Applying for nonprofit status with the IRS

Get Help Filing a 501(c)(3) in New York

The Office of the New York State Comptroller reports that as of 2017, New York State led the country in nonprofit employment, with over 1.4 million jobs in the nonprofit sector. The Comptroller’s office also reports that educational organizations made up 20.4% of all nonprofits in the state, surpassed only by healthcare organizations.

The total scope of nonprofit services in New York City and state cover a wide variety of fields. New charitable organizations can fill service gaps and provide even more support to vulnerable populations in New York. The following resources may provide help filing a 501(c)(3) in New York:

- How to Start a Nonprofit Organization in New York

- IRS 501c3 Application Preparation – Start a 501c3 Nonprofit

- CharitiesNYS

First in Family Fund provides this list strictly for informational purposes. It does not constitute our endorsement of any particular firm, practice, or service provider. For more information on 501(c)(3) filing help, please refer to the New York State Office of the Attorney General and the Internal Revenue Service.